Guide to Private Equity Investment Strategies

The boom in private equity shows no sign of abating.

At the end of 2022, estimates of dry powder - the money held by funds waiting to be invested - surpassed $3.4 trillion.

Furthermore, purchase price multiples (PPM) have been close to 10 for almost five years. It should therefore come as little wonder that private equity firms are so keen to develop market winning strategies.

DealRoom helps many PE firms in deal management and In this article, we look at the main PE strategies and how each one functions.

Key private equity investment strategies

- Venture capital (VC) investments

- Growth Capital

- Real Estate

- Mezzanine Financing

- Leveraged Buyout (LBO)

- Fund of Funds (FoF)

1. Venture Capital

Venture capital (VC) is the branch of private equity that focuses on startup and high-risk businesses.

Nowadays, we tend to think of these as being young, Silicon-valley based technology companies, but that overlooks the fact that high-growth, high-risk startups could occur in any industry.

For example, most of the big food conglomerates now have their own VC branches that invest in food start-ups that capture new trends.

In most cases, these startups will possess most of the following characteristics:

- A new product or service that claims to have a competitive advantage

- A different business model

- Fast revenue growth (but often running losses)

- High debt levels used to fund initial expansion

Venture Capital investing is now at the forefront of private equity, with a massive infrastructure in place for finding young companies with the potential to disrupt markets.

In 2020, total global VC investments were $300B - a remarkable fee given that the world was in the midst of a catastrophic pandemic.

This figure encompasses all of the different phases of venture capital, which are as follows:

- Seed stage: These businesses are often just an MVP (minimum viable product) that need funding to progress to become commercially viable. In most cases, the funding is relatively small, minimizing the VC investor’s risk but giving them plenty of upside if the business becomes a success further down the line.

- Early stage: Further on from the seed stage, early stage companies are already operating commercially. What investors want to see here is double digit monthly growth of revenue (and perhaps customers or users) that suggests the company is a good place to invest their capital.

- Late stage: As the name suggests, this funding is aimed at companies that already have traction in the market. Most companies at this stage have already received some funding, and may now be looking for advice as much as capital, as the business begins to navigate more competitive markets with much larger companies.

2. GrowthCapital

Growth Capital is generally provided by private equity companies to more mature companies to boost their growth.

This form of financing is sometimes referred to as ‘expansion capital’, and requires the company receiving the funds to develop a detailed, step-by-step business plan for the private equity investor showing how the funds will be used.

Growth capital can be used for:

- Expanding into new markets

- Developing partnerships

- Acquisitions

- Investing in capital (machines, real estate, etc.)

- Sales and marketing

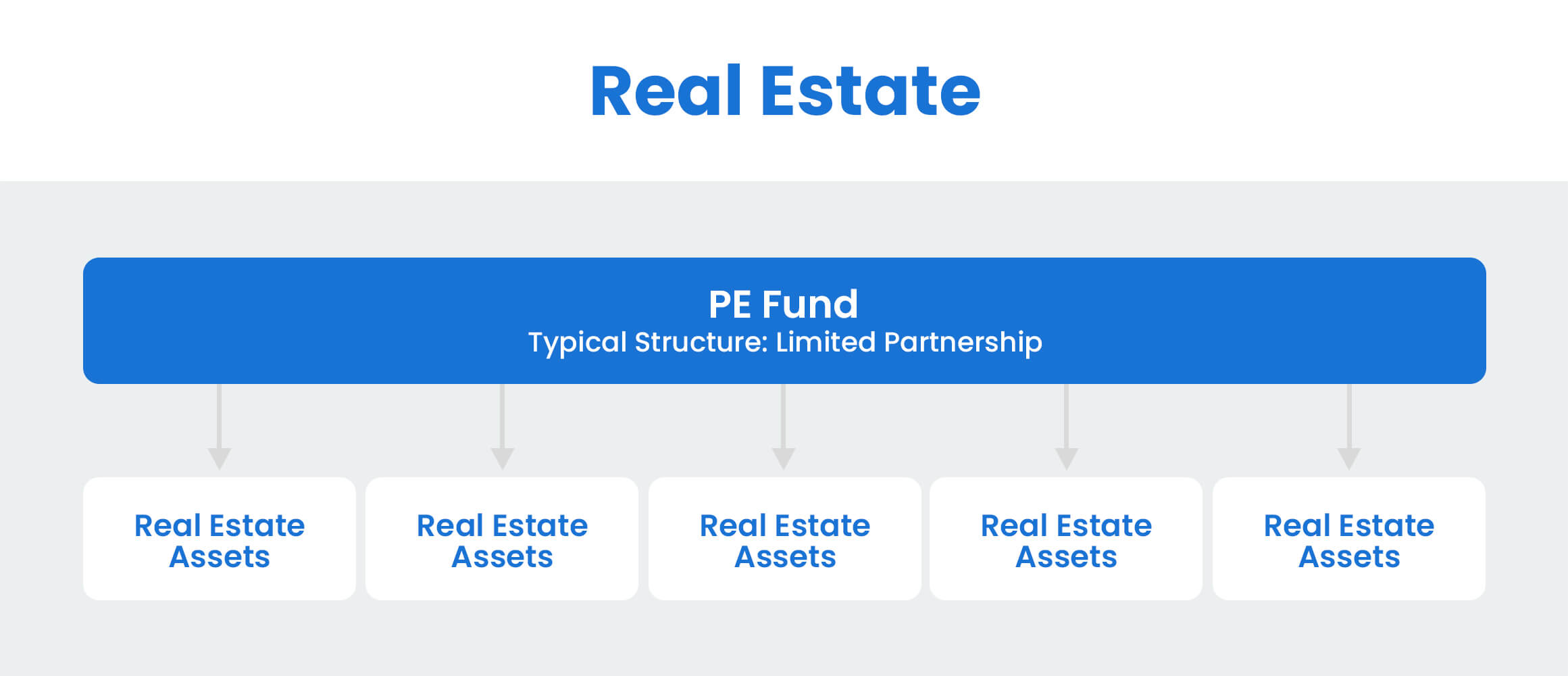

3. Real Estate

Real estate is another avenue of raising private equity capital. This asset class involves a group of investors pooling to invest in properties.

The four different strategies utilized here include:

- Core. In the stock market, the term ‘core’ is used interchangeably with ‘income.’ Core real estate investments are investments made in low-return/low-risk properties that generate regular cash flow.

- Core Plus. Core plus investments are a tad less conservative. This investment is in the moderate return/moderate risk category. Apart from the cash flows associated with the previous model, this type aims to take a value-added element approach as well. Core plus owners may be able to increase cash flows by making small improvements in management, the physical property, or the quality of tenants.

- Value Added. Value-added investments are medium-to-high return/medium-to-high risk. This strategy is all about buying properties with little to no cash flow but that great potential. This type of strategy is applicable to properties that have substantial capital constraints, management issues or need physical improvements.

- Opportunistic. Opportunistic investments are high risk/high return. This strategy involves acquiring properties that require a lot of enhancements, even more than value added. It may take years for investors to start seeing returns from these investments. Some types in this category include mortgage notes and raw land. Typically, these investments have limited partners due to the high risk involved.

Check also:

Data room for real estate transactions

4. Mezzanine Financing

Mezzanine financing divulges from the other investment strategies on this list because it consists of both debt and equity.

Companies acquiring debt capital provide the lender with the option of converting to an equity interest or full ownership in the company if the funds are not appropriately repaid.

It is critical for companies that seek mezzanine financing to be evidently profitable, have a good reputation, and established the product or service.

The primary reason why so many choose this growth equity option is the ability to get capital injection without having to lose equity ownership – provided the debt can be repaid in full and on time.

Since mezzanine financing is seen as being similar to the equity position on the balance sheet of a portfolio company, this option can also garner easier financing assistance from a bank.

There are also downsides to this type of financing. This is primarily due to the lack of collateralization of assets. This puts the lender at a major risk.

Therefore, this is typically undertaken by less conventional lending institutions.

On the other side of the deal, the target company typically has to shell out a larger interest rate and abide by stricter terms.

5. Leveraged Buyout (LBO)

Leveraged buyouts can be highly rewarding.

In this asset class, the company takes up a large amount of capital – through bonds and loans – to acquire other companies.

Top private equity firms utilize debt instruments to comprise of a majority, if not all of the purchase price. They invest in private companies, help manage and improve them, and then exit once they feel they have generated enough returns.

The buyout is leveraged with as much as 90% debt and only 10% being contributed by their own funds.

Since there is high utilization of debt, it can result in substantial interest payments for the target company.

The idea of a leveraged buyout is to make enough returns on the acquisition to offset the interest cost. Many private equity firms choose this option because it can generate a substantial amount of return while only risking a small portion of their capital.

PE firms raising capital through leveraged buyouts may also sell a portion of their acquisition for a profit while holding on to the remaining portion to reduce debt.

6. Fund of Funds (FoF)

A fund of funds (FoF), or a multi-manager investment, is an investment made in private equity funds rather than directly in bonds, stocks, and securities.

Fund of funds is often associated with greater investment diversification and lower risk.

Adversely, these funds often succumb to an additional layer of fees, which can leave them costlier than anticipated. Investors may also run into difficulty finding qualified fund managers.

Special Situations

Special situations are abnormal events that have a significant impact on a business’ future. Accordingly, special situation funds are equity funds that are after companies are in said special situations.

Most of the profits generated here are through a change in the valuation of the company. Examples include large company spinning off a business unit as its own entity, private equity acquisitions or mergers, bankruptcy proceedings, and tender offers.

This type of investment also common among hedge funds.

Stages of venture capital financing

Among the different investment types, venture capital is usually not an ‘introduction to private equity’ because of its high risk and high reward nature.

The likelihood of failure among private companies backed by venture capitalists can be startling.

Most of the VC funds tend to make a sizeable number of deals with hopes that one or two become actually successful.

This helps the fund compensate for several failed investments while still attaining a profit.

As all in nearly all aspects of business, venture capital financing doesn’t happen in a vacuum nor overnight. Venture capital financing warrants distinct private equity stages:

- Seed stage

- Early stage

- Late stage

1. Seed Stage

The funds involved in the seed stage are relatively low and the business is typically not more than an idea or concept versus a working good or product.

The funds raised during this stage are often delegated to research, development, or business expansion.

2. Early Stage

In the early stage, VC investors aim at companies with complete and operating business models.

Additionally, the product made by the company has a good demand in the market and the business typically achieves growth of 20-30% every month.

3. Late Stage

The late stage involves established entities looking for high levels of funding to support significant strategic initiatives.

So the company is able to get a couple of rounds of financing, they need to have a proven profitable record.

The product generated by the company should also have excellent traction in the market.

What is private equity due diligence?

Due diligence is the reasonable care, which is typically in the form of a thorough investigation, taken by a rational individual prior to completing a deal.

The lack of publicly available metrics on private companies makes due diligence an absolute necessity for private equity firms.

DealRoom works with hundreds of private equity firms on their pre-transaction due diligence, and this work typically tends to focus on the following areas:

Financial Situation – Many professionals recommend not to make an investment that is more than 5% of your total net worth. This can have a positive effect on cash flow and greatly reduce risk.

Risk Tolerance – Business investments are made with the objective of making money.

Since even the best private equity primer investment is prone to failure, there should be a risk tolerance decided upon before completing the investment.

Business Model – The business model of the company should be well understood before making any investment. Any investment is a gamble but it is worth knowing the odds of success before throwing the dice.

Market Trend and Size – Market size plays a huge role in determining the potential of an investment’s success. A great private equity example would be Uber. Uber was able to attract a lot of funding initially considering the huge space in the taxi aggregator model.

The analysis of the market size and trend is very difficult and time-consuming, but getting it right can help reap rich rewards from the investment.

Competition – A business’ competition can have a huge impact in terms of profitability.

It is vital to analyze aspects like cost, growth rate, pricing, and the quality of the competition in order to make better decisions. Many of the investments go to companies that are in the infancy in their segment.

Knowing your opponent helps improve the likelihood of success and helps you stay ahead of the game.

Which strategy is best?

The answer to this question is the same as many in business: it depends.

As with anything, the success of any investment strategy is contingent upon an excess of external factors such as the economy and social or technological trends.

Comparing VC and PE firms, both have the potential to generate substantial profits.

However, PE firms are capable of paying out more than venture capital firms largely due to factors like bigger fund sizes.

Many large buyouts may not be as lucrative since debt with a high yield does not come cheap, but middle market buyouts remain attractive even now.

Overall, there is a greater amount of opportunities for seeing growth in emerging markets than in developed markets.

The availability of greater profits nationwide has fuelled the growth behind PE firms.

Useful Links

Get your M&A process in order. Use DealRoom as a single source of truth and align your team.

.png)

.png)

.png)

.svg)

.png)